Understanding Market Performance

Travel & Tourism

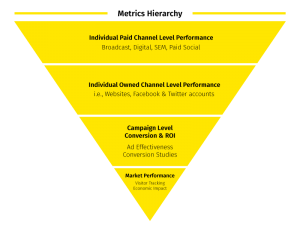

Measuring marketing return on investment can be particularly difficult for destination marketing organizations. While charged with influencing leisure travelers to visit, they don’t directly manage the products and services they are expected to sell. Most are public entities that are under increasing pressure to produce results or risk losing their funding sources. Luckily there are more measurement options than ever, particularly related to digital marketing channels. But navigating which of those are worth the investment can be difficult.

Many destination marketers feel overwhelmed, easily swayed by high-pressure salespeople and lose sight of the end goal, which is essentially to create marketing campaigns that clearly deliver on stated business objectives. All too often, clients purchase expensive analytic tools without giving real thought to what role they play in helping gain efficiencies. It is important to realize that not any one tool can do it all. A successful measurement model includes multiple tools, which, when used together, paint a holistic picture of marketing performance.

This blog aims to provide readers with a fundamental understanding of the types of measurement options available and the purpose each serves in guiding informed marketing decisions.

Individual Paid Channel Performance – this most basic level measures how effective paid media placements are at either driving awareness or engagement. Generally, this is measured by looking at individual channel performance and does not measure the synergy or totality of ad placements as a cohesive campaign. These measurements are reasonably standardized across the industry. Media planning tools, digital ad servers and website data such as Google Analytics are helpful in measuring:

- Impressions

- Reach, frequency

- Click-through, cost-per-click

- Video views, completed views, cost-per-view

- Website traffic

- Travel guide requests, email opt-ins

- Post engagements, cost-per-post engagements

Individual Owned Channel Performance – similar to paid media, this level measures how effective owned channels like websites and social media channels are at connecting potential visitors with information about the destination. Generally, like paid media, this is measured by looking at individual channel performance and does not measure the synergy or totality of marketing efforts as a whole. A destination is likely measuring metrics such as:

- Sessions, average session duration, 5 min plus session duration

- Bounce rate

- Goal completion rate

- Newsletter sign-ups

- Travel planner order rate, travel planer view rate

- Traffic from paid media sources

Campaign Conversion & Return on Investment – in most cases, primary research is fielded to gauge the effectiveness of overall marketing campaigns in generating visitation. Unlike the previous sets of metrics that measure the performance of an individual channel, here the goal is to measure the effectiveness of the campaign as a whole.

Ad effectiveness studies are still the most comprehensive tool we have in gauging overall campaign performance. Most destinations field this study after high season, where the bulk of marketing dollars are spent. These studies directly correlate advertising spend to marketing-influenced trips to a destination.

- Destination awareness

- Ad campaign awareness

- Message resonance

- Conversion to visitation

- Return on ad spend investment

Unfortunately, the research mythology isn’t keeping pace with the complexity of the new media landscape. Aligning the correct media spend with sample markets can be difficult and, in some cases, overinflate ROI figures.

Some research companies have improved methodology that more accurately gauges whether a respondent has in fact had an “opportunity to see” the campaign being tested. This new methodology only applies to digital buys that are pixel tagged, but it is a significant gain in aligning the paid media target audience with the recruitment of respondents into the study.

Conversion studies—separate or in tandem with ad effectiveness—involve re-contacting consumers who have “inquired” by providing the destination with personal data to determine if they have, in fact, visited. This data is helpful in understanding which combination of consumer touch points is most effective in driving visitation.

And lastly, there are new enterprise tools available that directly link digital marketing spend to visitation such as Adara, Sojern and Arrivalist. While these tools leave a void in understanding total campaign performance, they can be helpful for optimizing digital media spend. These systems work best for larger destinations where a significant amount of product is being purchased through OTA’s. However, they can be expensive. Destinations need to weigh whether or not the additional spend is justified.

Market Performance – Visitor tracking research is fielded to determine visitor profiles and behavior while in market. Most destinations field at least every other year. Consider breakouts aligned with a destination’s seasonality and regional makeup. There are many research companies that specialize in this type of study, each with their own proprietary methodology.

- Visitation

- Spending

- Party Size

- Length of trip

- Destination spend

- And other in-market behaviors

Measuring economic impact and the overall impact tourism has on a destination is also essential. There are two major players in this category: Tourism Economics and Dean Runyan & Associates. And in some cases, destinations rely on their university system to provide this research.

- Visitor volume

- Traveler spending

- Local and state taxes

- Jobs

It’s no small task to develop a successful measurement model. Ensuring metrics tools align to business and marcom goals is important. Measuring something just because you can, doesn’t mean you should. The tools outlined here are aimed at showing progress and effectiveness, but also provide guidance and insight into what’s not working and why, so that destinations can act.

While destination marketing executives may not have to become research experts, having a clear understanding of methodologies, sampling and algorithms becomes essential to knowing what the metrics are actually saying. In future blogs, we’ll share thoughts on how to apply what you’ve learned from the data into actionable plans.