Branding and Banking: Your Brand May Be More Important Than You Think

Financial Services | Thinking Big

With so many things pulling today’s banking leadership in different directions, a strong brand is perhaps the single most efficient and effective way to navigate the leadership toward creating short-term growth and long-term competitive advantage. But, it can’t work without a little bit of effort.

At BVK, when we work with a financial institution’s leadership team, the first thing we address is the fragmentation of their operating structure. In our experience, most are structured to operate in silos, with each business unit set up to develop its own unique set of objectives, strategies and activation methods. Not surprisingly, the marketing department also operates in a silo. Disconnected from the rest, these teams are busy designing messages that promise to meet the rapidly evolving needs of their prospects. Sounds great, right? Yes and no. Yes, having the insights to understand the target audience’s motivations is critical, but when they lead to work that’s disconnected from what the other business units are prepared to deliver on, the work will not only fail, it will also induce corrosive damage to the reputation of the bank.

Brand is what we “say” it is

We refer to this way of marketing as, “the brand is what we say it is.” The issue with this approach is when the brand broadcasts a promise, it creates an expectation in the marketplace. But when that expectation doesn’t take into consideration the other business unit plans, the customer or prospect experiences friction and inconsistency across touchpoints. This results in the audience seeing the bank as disjointed, self-serving and inconvenient. Their disgruntled response soon begins to take the form of discontent, which leads to skepticism and inertia.

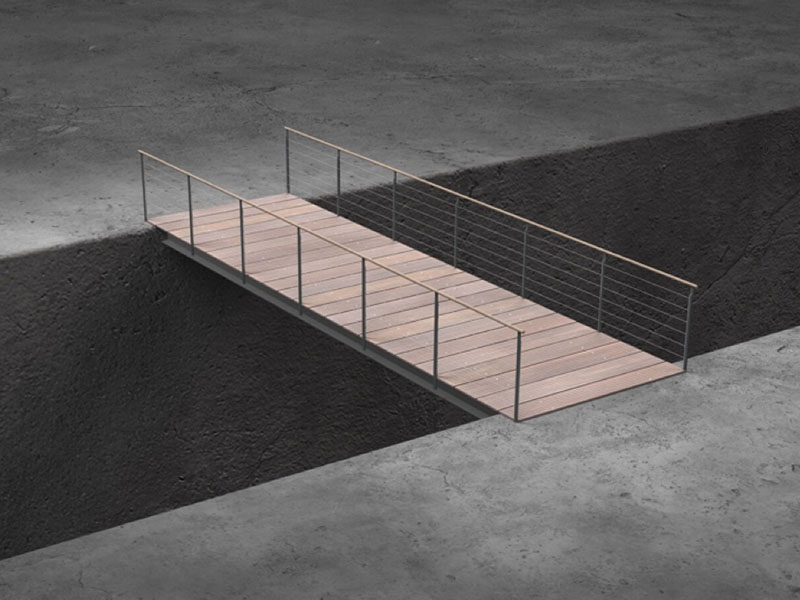

The good news, however, is that with a tight focus, the brand’s role can be elevated to serving as the skywalk used to bridge existing gaps between silos. Now the brand can have a dramatic impact on the efficiency and effectiveness of the organization, creating the short-term growth and long-term competitive advantage mentioned above.

Brand is in everything we “do”

By adopting the mentality of “brand is in everything thing we do,” the brand’s promise can help guide the leadership’s business and innovation strategy, then apply itself as the filter, or lens, through which the different business units’ view, create and execute their strategies across the organization. Fulfilling on “brand” now drives all internal and external decision-making related to culture, product/service offering and future growth initiatives. And, instead of fragmented communications and behaviors, audiences can enjoy consistent and distinctive experiences at every touchpoint – thereby reinforcing their perceptions of the organization, and ultimately, generating a greater share of wallet. With this increased clarity, along with continuous improvement in the customer experience, the bank’s ability to expand services or enter new markets can be faster, more cost effective and impactful.

At BVK, we help banks and other financial institutions shift their growth strategies from a reliance on often overlapping and easily copied marketing claims of better service to core business competencies that create unassailable long-term competitive advantage. Embodied in this approach is an emphasis on Insights, Innovation and Impact that can be the basis for market differentiation and profitable business growth.

Kevin Steltz and Mike Eaton lead brand and business strategy planning and operational alignment for BVK clients in the financial services sector. For more information about our approach please respond to Kevin or Michael.