From Siblings to Symbiosis

Healthcare

Business Model Strategy for Integrated Financing and Delivery Care Systems

Over the past twenty years, health systems and insurers have increasingly eyed up the same competitive space at the intersection of health care financing and delivery.

Providers see sponsored health plans as the next logical step beyond accountable care organizations, and as the payoff on clinical integration investments. Health insurers have acquired hospitals and physician practices, convinced that they can more efficiently deliver care and reduce total costs.

Both are motivated to control a greater share of the total medical spend. Each believes they can manage premium dollars more efficiently (and profitably) than the other. Yet, today, few health systems or insurers have realized the theoretical gain from the aggregation of health care financing and delivery. The reason is difficult business model trade-offs between a clinical enterprise that defines success as unit reimbursement and volume, and insurers which see those billable encounters as cost that reduces margin.

These provider-payer integrations are frequently organized as sibling lines within an enterprise whole that often compete for control of the premium dollar, rather than symbiotic functions aligned around a single goal of profitably growing the parent enterprise’s share of total medical spend.

Shifting the Business Strategy

The competitive tension between a clinical enterprise and a health plan cannot wholly be solved by the vertical integration of the provider and payer functions. The “sibling rivalry” over control and distribution of the premium dollar too often forces decision-makers to make trade-offs between provider profitability and payer margin and being price-competitive in the market.

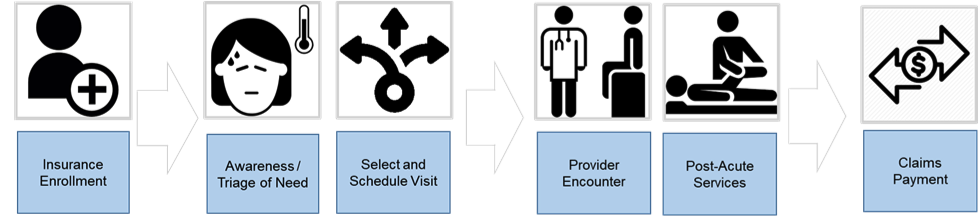

What is needed is a new business approach that is symbiotic, in the sense of both parties gaining advantage from their association with the other. That advantage must be measured as an increase in the value of the whole across a continuum of experience (depicted below), not simply improved performance by the corporate sibling parts and profitability the respective “owned” elements of the care journey.

Historically, business strategists have not focused on a value of the whole across the financing and delivery value chain from the customer perspective. Instead, the focus of innovation was most frequently on discreet steps in the chain, often based on proprietary platforms and applications that did not permit real-time business and clinical interoperability or seamless member navigation across service episodes.

Today, market entrepreneurs and system intrapreneurs are rethinking the value chain and forcing a new look at how we define the continuum of service. They are approaching financing and delivery of care not as separate transactions or lines (siblings under one corporate roof), but, as a singular bundle of value that gives consumers on-demand access and guided navigation across episodes of service.

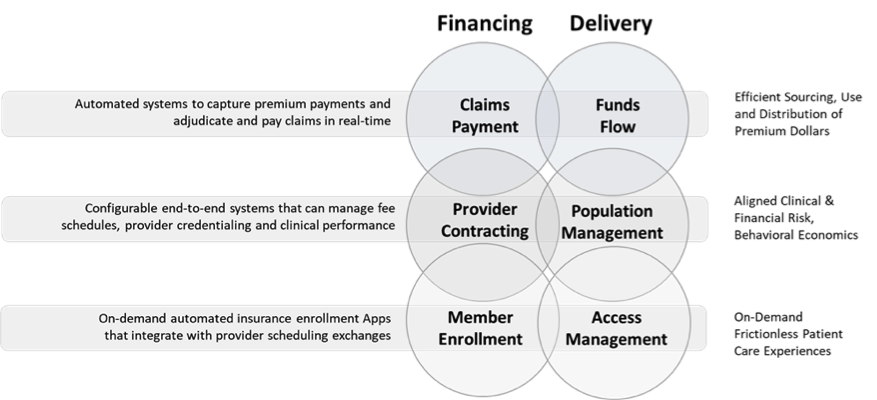

The result is an enterprise made from symbiotic health care financing and delivery stacks, that together create a new value chain that:

- Enables efficient sourcing, use and distribution of premium dollars

- Aligns clinical and financial risk, and behavioral economics

- Supports on-demand, frictionless patient care experiences

Graphically noted below, this new business enterprise functions as a general contractor at the intersection of the financing and delivery stacks, and horizontally buys, builds or partners for the required financing and clinical delivery components of the value chain. It is less two organizations owned by one corporate parent, and more two sets of functionalities that may remain legally distinct, but which operate in a symbiotic manner that creates a new bundle of value for the corporate parent.

For a health system and its provider-sponsored plan, this approach requires a shared vision for how success is defined and measured, and a willingness to build value into the whole of the care experience, not simply on the individual station-to-station stops along the way.

We believe that the strategy can deliver on three critical success factors for managing premium dollars and optimizing enterprise outcomes for defined populations, specifically:

- Prevention. Identification and mitigation of the physical, emotional, social, spiritual and financial drivers of adverse outcomes and higher cost among members

- Diagnosis and Treatment. Organizing and expediting access to highly reliable systems of care and measuring and monitoring quality and efficiency for purposes of accountability and improvement

- Maintenance. Equipping people to self-manage the risk factors that impact the progression of chronic disease and drive adverse events and higher total cost of care

Health systems which can organize their sibling clinical enterprise and sponsored health plans around this business model have the clearest opportunity to create market-driving value. It is our experience that this is not an easy shift to make; regulatory considerations, the divergent mindsets in the financing and delivery sectors, and legacy “closed” data systems are considerable challenges. But the new business strategy, if executed effectively, can be the distinctive value that enables health systems and their sponsored health plans to shift from siblings which often compete for a control of the premium dollar to symbiotic partners that, together, capture a greater share of the total medical spend.

Michael Eaton, Brand+Lever Principal

Paula Serios, Brand+Lever