Creating, Not Making, Choices: Overcoming Inertia in Bank Growth Strategy

Financial Services

“Grow the business.”

“Protect the bank.”

Recently, I worked with a financial enterprise to resolve an internal tension between those two points of view that had created inertia in its growth strategy. Interviews with key staff had identified “growth” and “compliance” priorities that were perceived as pitting customer-facing teams against loan operations in ways that translated into rework and delays in approvals and closing.

On one side of the culture divide were customer-facing teams that viewed the lack of an agile response to customer needs as being the biggest threat to the bank. They worried about being left behind in the market as digital platforms, AI and new technologies increasingly transform the banking experience for customers who want customizable solutions to their needs on their terms, now.

On the other side of the divide were teams that saw the biggest threat to the bank as being compliance with government regulations and mitigating the risk of loss. These teams draft compliance policies to eliminate the risk of fines; they manage loan operations to protect against losses. And, they put in place security systems designed to counter the risk of data breaches and legal exposure.

For the record, the “growth” and “compliance” points of view are both important, and their adherents well-intentioned and talented contributors to the bank’s success. Unfortunately, when the two perspectives must work together across episodes of service—to expedite approval of a personal loan or complex commercial lending instrument, for example—the result is often a clash of cultures that translates into rework and delay in the documentation and approval process.

Creating Rather Than Making Choices

For my client, the binary positions of “growth” and “compliance” forced staff to continually optimize between risks of noncompliance and the rewards of more aggressive lending growth. There was a constant “trade-off” between loan officers looking for new products and process flexibility to increase the likelihood of getting customer loans approved and loan operations and compliance policies that protected the bank but were perceived to chill process and product innovation. Over time, this push and shove created tension that had a corrosive effect on service and willingness to innovate.

My client needed a strategy to bridge the cultural divide between growth and compliance. We found a framework for bridging those differences in the idea of integrative leadership thinking put forth by Jennifer Riel and Roger Martin in their work, Creating Great Choices: A Leader’s Guide to Integrative Thinking (Harvard Business Review Press, 2017).

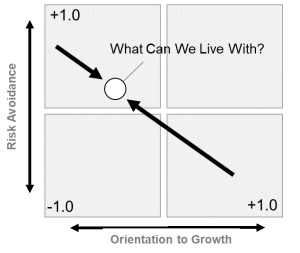

Riel and Martin make the case that most leaders think in terms of trade-offs between the options in front of them. In this model, leaders and teams constantly re-litigate the question of “what they can live with” in terms of risk as they work to balance the growth and compliance perspectives.

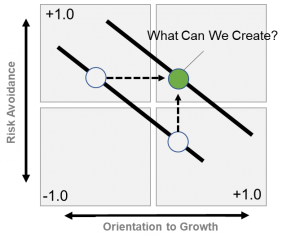

The authors argue that leaders should not limit themselves to make a choice between options A and B, but, rather should integrate the best of their current options to create a choice that is entirely new, as illustrated in the graphics below.

MAKING A CHOICE

CREATING A CHOICE

(Adapted from Riel and Martin)

Getting Started

Is there a cultural divide impeding your ability to accelerate service improvements? Do your leadership team and business line executives need to move beyond the optimization of growth and compliance—figuring out what you can live with—to get to creating new choices that can both protect the bank and grow it?

We have found the following three-step process instructive for banks looking to overcome inertia in their growth strategies that result from the cultural growth versus compliance divide:

Stage 1: Assessment. Assess operating processes and performance across episodes of service. Are there cultural disconnects that prevent you from gaining growth strategy momentum?

Stage 2: Episode of Service Mapping. Bring customer-facing teams and back-office and compliance teams together to map common episodes of service to set service standards and identify technical and behavioral barriers to meeting defined performance standards.

Stage 3: Prototype and Piloting. Task the Episode of Service teams to create new choices for organizing and operating across service episodes to achieve performance standards. Charter teams to deploy the prototypes and measure and report impact on customer satisfaction and identifiable risk, and retention and recruitment of new business.

Brand+Lever can help with this process. For more information, please contact Mike Eaton at [email protected], or Kevin Steltz at [email protected], or call us at (414) 228-1990.