Part 2: Refilling the Patient Pipeline – the Key Step on the Road to Financial Recovery

Healthcare

Covid-19 is a Fracture event, disruptive on such an unprecedented scale it changes our worldview forever, having perhaps its greatest impact on healthcare. The negative financial impact is daunting – with so many appointments and procedures cancelled, it is imperative for healthcare systems to refill their patient pipeline. But this patient disruption must be addressed carefully by anticipating how COVID-19 has impacted brands and consumer selection criteria and experience expectations.

With no history to guide us forward, BVK recognized that solid and timely data is critical to understand the rapidly evolving nature of consumer attitudes and expectations as this crisis plays out. Therefore, we are fielding a 3-wave national survey occurring in late April, May and June. Our study measures brand impacts and consumer expectations for re-engaging with healthcare systems. This blog is the second in a 5-part series exploring our findings and related topics.

What will it take to build confidence and get people to reengage?

In my previous blog, I talked about how BVK’s national study showed that each patient will create their own unique “mind map” of what it will take for them to reengage with healthcare providers. This includes things healthcare providers control, as well as “risk indicators” such as the number of new COVID cases being diagnosed, and restrictions on behavior suggested (or mandated) by the government.

Yes, this makes things more complicated, but from the data there are clear needs and expectations that emerge.

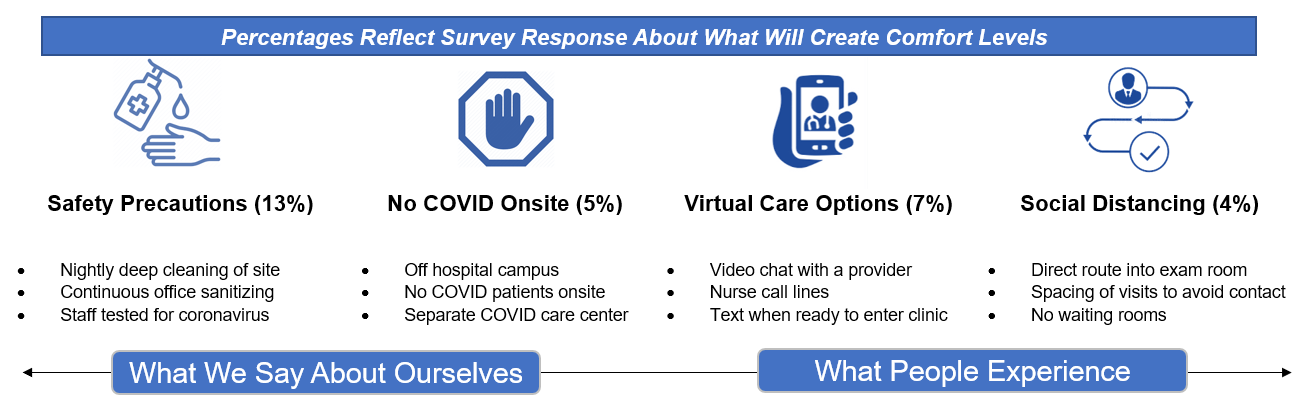

When asked what it will take specifically for them to re-engage, survey respondents on an open-ended basis shared the following (the groupings are ours):

You will notice something when you look at the numbers associated with each of the 4 categories of responses. The cumulative numbers for each of the categories is reasonably small. It was a hard question for them to answer on an unaided basis. They know they were uncomfortable, but do not really know what they should consider in making a sound decision.

It is up to us to help. Based on the results of our survey and other national studies, there are three recurring desires that emerged: Confidence, Control and Convenience.

Confidence is the gateway that must be passed through to reach other decision criteria. It is how consumers want to feel, and it is what we need to earn by virtue of how we understand their perception of risk, validate their right to have high expectations and respond. The data above gives you the performance aspirations and expectations needed to gain their confidence.

Control speaks to an aspiration they have about their lives overall, as well as in the healthcare setting. People feel they have lost control over much of their lives because of COVID-19 restrictions, and as recent protests show, they are increasingly motivated to exert themselves to regain a sense of personal autonomy. While we cannot give them complete control, we must consider how to engineer some choice in care locations, settings, times and technologies so that they understand we are trying to enable them.

The last desire is convenience. If you make the process of reengagement confusing and painful for those who postponed appointments and procedures, they will simply go elsewhere. And they will remember your lack of responsiveness when making future care decisions. As with control, you will need to purposefully frame all that you are doing to make things as easy as possible to get credit for it.

In summary, while there will be variability in risk thresholds between individuals, there are macro desires that need to be addressed. So overarching the content of how you are doing this is the context that you understand and validate their desires and are doing everything possible to help them feel confident and in control.

In our next blog, we will explore one aspect of care that has been greatly advanced by the COVID-19 crisis – Virtual Care. It represents particular opportunity with certain groups, if incorporated into a broader care access plan.

Feel free to reach out to me at [email protected] if you have any questions or comments. And join us for a presentation on more of our survey findings and a complete recovery plan to refill the pipeline in our Road to Recovery Webinar. Click on a date option below to register: