The First Dollar Spent: An Emerging New Market Below High-Deductible Thresholds

Healthcare

Recently, Mylan Pharmaceuticals — under pressure from customers and politicians — conceded that the price increases it pushed through for its EpiPen had created a hardship for people with high-deductible plans.

The anger focused on Mylan Pharmaceuticals exposed a broader challenge with the increasingly popular high-deductible health plans (HDHP) and their shift of cost from employers to employees.

In 2004, only 55% of employee health plans had a deductible. Now, 81% do. In January 2014, 17.4 million employees were enrolled in HDHPs according to a report by America’s Health Insurance Plans (AHIP). And that number is growing — fast. A 2015 study released by the PwC Health Research Institute found that 44% of employers will offer HDHPs as the only benefit option for employees within the next three years.

The story is no different on the exchanges. The 65% of people choosing Silver Plans sold on federal and state-run health exchanges pay 30% of their total costs out of pocket with an average annual deductible of $2,907 per person.

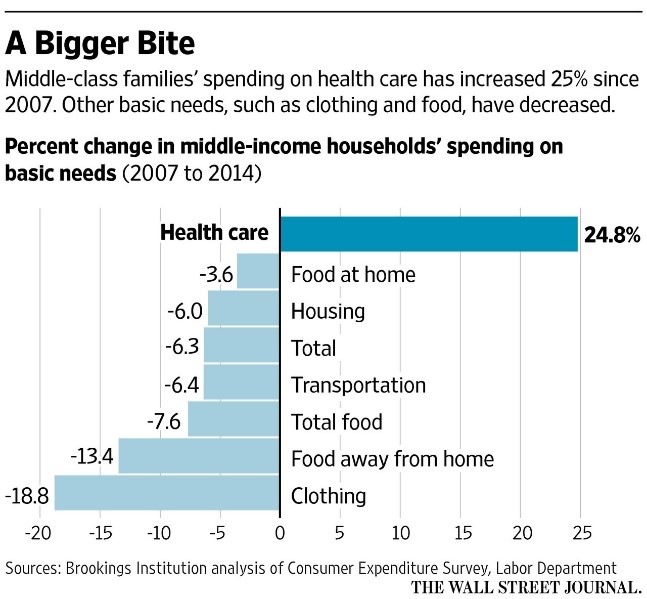

Higher deductibles are intended to make people think twice before using low-value health care services. In theory, they should incentivize people to seek out preventive care services and lead to lower premium costs. But, in fact, health plan premiums are again rising at double-digit rates. And while more people are insured, more Americans than ever are on their own for the first several thousand dollars of health care costs. The impact of this shift has been that health care today takes a bigger bite of our family budgets (see graphic). It also means that health care providers are increasingly competing with basic family necessities for scarce family financial resources.

Consequentially, there are health system strategy implications.

Health system business strategies are often based on an assumption that service offerings will be “covered services.” And they may be — but payment for those covered services may actually come out-of-pocket from families below their deductibles and with stressed budgets. That becomes a critical consideration along with medical necessity and market demand when thinking about hospital and physician market strategies.

At BVK, we believe that knowing best what consumers want and need is a core source of competitive advantage.

Not every consumer in the market is willing and/or able to make cash-flow purchases up to a high-deductible threshold. Knowing which consumers will dig into their cash (and credit) to purchase services — and what services they will pay for out-of-pocket — is critical to succeeding in the market.

We believe that there is an entirely new market emerging in the “cash end of the pool” that health systems absolutely must engage. Part of that imperative is the reality that out-of-market alternatives are eagerly looking at this cash market. Competitors are emerging, funded by private equity and fueled by big ideas that dis-intermediate the primary care provider and dis-integrate the integrated health system by stealing market share below high-deductible plan thresholds. They are Clayton Christensen’s classic disruptive innovators and they have their eyes fixed on the “first dollar” spent by consumers on health care services.

BVK has proprietary data which can help health systems build smart strategies for this below-deductible cash and retail market.

Our insights into the impact of rising deductibles and out-of-pocket spending can help health systems evolve their go-to-market strategies from one that assumes a third party payer writing the check, to one that will succeed in a market where the consumer has to reach for his or her own wallet.

For more information on how your organization can build effective strategies that respond to the unique challenges and opportunities posed by the growth in high deductible plans, contact us here.